Electric Two Wheelers Market.

The fastest transition nobody is fully prepared for.

MarketGenics has studied one of those markets that looks obvious in hindsight — and invisible while it’s forming.

Electric two-wheelers.

Not cars.

Not trucks.

Not the loud, capital-heavy parts of electrification.

Two wheels.

And yet, the numbers tell a story that’s hard to ignore.

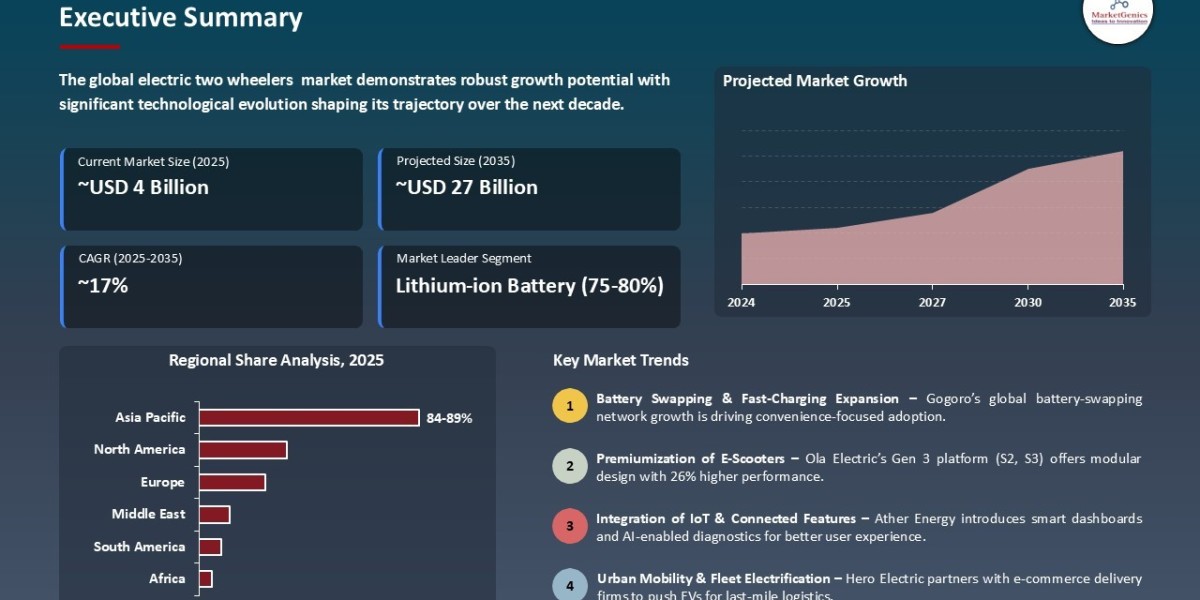

The Electric Two Wheelers Market is valued at USD 4.6 billion in 2025.

By 2035, it reaches USD 26.9 billion.

A 17.6% CAGR over a decade.

That’s not enthusiasm.

That’s structural momentum.

The demand didn’t come from ideology.

It came from cities.

Congestion.

Fuel costs.

Last-mile economics.

Delivery density.

Urban reality.

In Asia Pacific — where density, price sensitivity, and mobility needs collide — electric two-wheelers didn’t need persuasion. They needed availability.

And once subsidies, battery prices, and charging solutions aligned, adoption followed.

Not because people wanted to be green.

Because electric made more sense.

That’s a pattern worth remembering.

The battery tells the real story.

Lithium-ion dominates the Electric Two Wheelers Market share with ~78%.

Not by accident.

High energy density.

Lower weight.

Fast charging.

Longer lifecycle.

And critically: declining costs through scale.

This mirrors every successful electrification curve we’ve seen before.

Technology matures.

Volumes rise.

Unit economics flip.

Lead-acid still exists.

Solid-state waits in the wings.

But lithium-ion is the workhorse carrying the market today.

And it’s doing so quietly.

Governments didn’t invent demand.

They removed friction.

In India, incentives under FAME II tied subsidies directly to battery capacity.

In China, the Green Vehicle Credit mechanism aligned manufacturing with adoption.

In the US, tax credits extended EV logic into motorcycles.

The result?

Lower upfront costs.

Faster purchase decisions.

Wider consumer reach.

In just four months, India’s Electric Mobility Promotion Scheme supported 3.7 lakh electric two-wheelers.

That’s not policy theory.

That’s demand unlocked.

But here’s the catch.

Charging infrastructure still lags.

Especially outside urban cores.

Especially in Tier 2 and Tier 3 cities.

Especially in emerging markets where grid readiness varies.

Range anxiety isn’t emotional.

It’s practical.

In regions where charging stations are sparse, adoption slows — regardless of subsidies or technology.

The Electric Two Wheelers Market doesn’t stall because vehicles aren’t ready.

It stalls when systems aren’t.

That distinction matters.

Something else is happening beneath the surface.

Electric two-wheelers are no longer just vehicles.

They’re platforms.

Connected dashboards.

OTA updates.

Predictive maintenance.

Geo-fencing.

Fleet analytics.

The Ola S1 Pro.

The Ather 450X.

The TVS iQube.

These aren’t just scooters.

They’re software endpoints on wheels.

Which raises a different question:

Who actually owns the customer relationship?

Manufacturing is consolidating — but not completely.

The top five players hold ~65% market share.

Enough to shape standards.

Not enough to eliminate competition.

Tier-1 OEMs dominate mature regions.

Tier-2 and Tier-3 players carve out niches — price, geography, use case.

Battery swapping companies emerge.

Fleet platforms integrate.

Charging ecosystems grow around demand.

This is not a winner-takes-all market.

It’s a systems market.

Asia Pacific isn’t leading by accident.

High population density.

Short commute distances.

Two-wheelers as default mobility.

Add rising fuel prices and policy support, and the transition accelerates.

India.

China.

Vietnam.

Indonesia.

Markets where electric two-wheelers don’t replace cars — they replace petrol scooters.

That distinction is why adoption curves look different here than in Europe or North America.

And why global OEMs are watching closely.

The opportunity is bigger than vehicles.

Battery swapping.

Lightweight EV components.

Fleet and delivery platforms.

Smart charging infrastructure.

Urban mobility software.

The Electric Two Wheelers Market doesn’t grow in isolation.

It pulls adjacent industries with it.

Just as importantly, it creates data.

Mobility data.

Usage patterns.

Energy demand signals.

Which raises another question:

Are companies treating this as a vehicle market — or as an infrastructure play?

A familiar mistake is forming.

Many still see electric two-wheelers as “entry-level EVs.”

Cheap.

Simple.

Transitional.

That framing misses the point.

Two-wheelers are often the first electrification decision a household makes.

They normalize charging.

They build trust in batteries.

They change expectations.

By the time cars arrive, the mental shift has already happened.

That’s why this market matters more than its size suggests.

The forecast is clear.

The execution risk is not.

USD 22.4 billion in cumulative opportunity by 2035.

High CAGR.

Strong policy tailwinds.

But outcomes will depend on:

• Charging rollout speed

• Battery supply stability

• Cost discipline

• Platform intelligence

• Localized go-to-market strategy

This is not a copy-paste transition.

It’s a region-by-region build.

So the real question isn’t growth.

Growth is already happening.

The question is:

Who captures value — OEMs, battery players, software platforms, or infrastructure providers?

Who understands the Electric Two Wheelers Market as a system, not a product category?

And who is still modelling this as “just another EV segment”?

One last thought.

Every major transition looks small before it looks inevitable.

Electric two-wheelers are already past the “if” stage.

They’re firmly in the “how fast, where, and who wins” phase.

The data is there.

The demand is visible.

The economics are moving.

The only thing left to decide is:

Are you watching this market — or actually preparing for it?