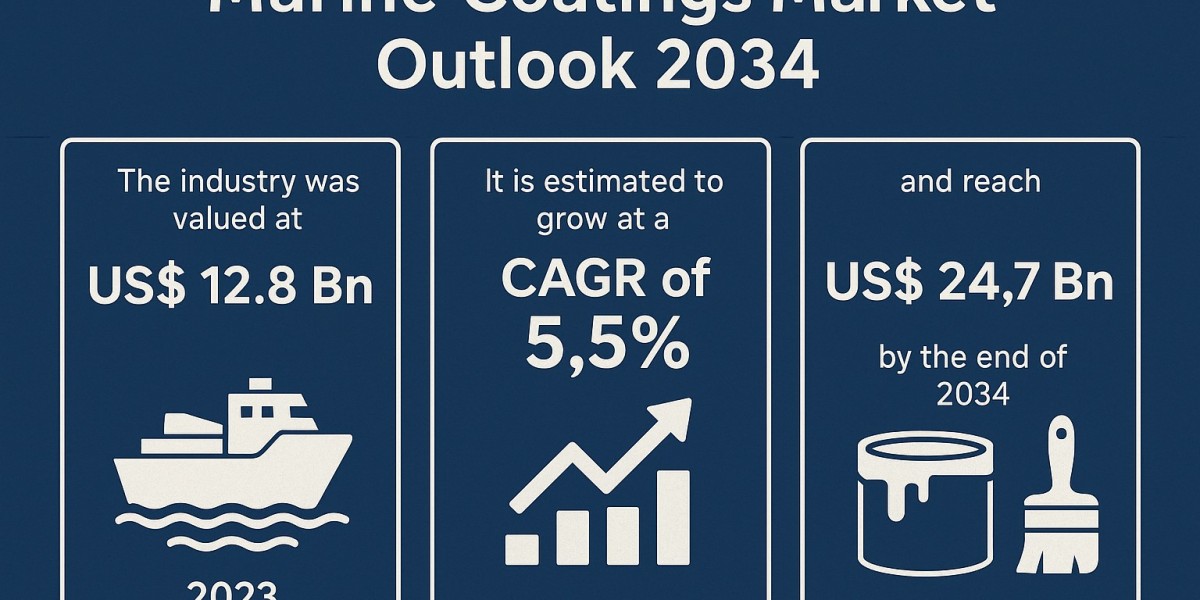

The global Marine Coatings Market is set for strong expansion, expected to grow from US$ 12.8 Bn in 2023 to US$ 24.7 Bn by 2034, advancing at a CAGR of 5.5% from 2024 to 2034. According to Transparency Market Research’s latest industry evaluation, the surge in demand for eco-friendly coatings, rapid growth in the global shipping sector, and accelerated investments in maritime infrastructure are key factors shaping market dynamics over the coming decade.

Eco-friendly Coatings at the Core of Market Expansion

A significant market driver is the increasing adoption of eco-friendly marine coatings, engineered to minimize environmental impact while offering superior performance. These coatings—covering anti-fouling, anti-corrosion, foul-release, and other protective functionalities—are designed to reduce emissions, limit biofouling, and enhance vessel efficiency.

Bio-based and biocide-free marine coatings are witnessing widespread adoption as the maritime industry responds to stringent environmental regulations governing emissions and ocean contamination. The shift toward sustainable raw materials and renewable chemistry is also fostering innovation across the supply chain.

The European Union’s research findings highlight an urgent need for such advancements, as the global shipping sector accounted for nearly 3% of GHG emissions in 2022, making sustainability-focused technologies a priority for regulators and shipping companies alike.

Expanding Shipbuilding Activities Fuel Market Growth

The marine coatings market is strongly influenced by continuous growth in global shipbuilding and increased maritime trade. Rapid globalization, rising consumer demand, and heightened naval modernization efforts are stimulating orders for commercial vessels, naval fleets, leisure boats, and offshore vessels.

Countries across Asia Pacific—including China, Japan, India, and South Korea—remain central to global ship production, collectively accounting for nearly 80% of the world’s shipbuilding capacity. This dominance is expected to continue, driving high demand for protective coatings used in dry docking, new ship construction, coastal operations, container vessels, and deep-sea marine applications.

The market is further bolstered by rising popularity of sailing, cruising, and marine leisure activities globally. High-performance coatings contribute to improved aesthetics, longevity, and durability of luxury yachts and recreational boats, creating new market pockets of opportunity.

Technological Advancements Drive Competitive Differentiation

Recent industry advancements reveal a strong push toward next-generation coating technologies, including:

Nanostructured coatings for enhanced durability and corrosion resistance

Copper-free antifouling solutions, aimed at reducing toxicity and improving vessel sustainability

Advanced epoxy formulations with improved adhesion and longer service life

Leading companies are investing heavily in R&D to meet evolving environmental compliance requirements and improve operational efficiencies for shipowners. Market participants are also forming strategic partnerships with shipbuilding corporations and naval organizations to expand global reach and accelerate product deployment.

Asia Pacific Leads Global Market Share

Asia Pacific emerged as the largest regional market in 2023, attributed to:

Extensive coastlines and maritime trade routes

Growing shipbuilding investments

Rising offshore exploration and port construction initiatives

The region handles a significant share of global maritime traffic, especially near the South China Sea and Indian Ocean. As per The Atlantic, nearly 400 Chinese vessels and 100 Vietnamese vessels traverse the South China Sea daily, contributing to heightened demand for protective marine coatings.

Europe remains another lucrative region due to stringent environmental regulations and heavy freight traffic. European ports handled approximately 3.5 billion tons of freight in 2022. The Dover Strait, which sees roughly 400 vessels daily, remains one of the world’s busiest marine routes, supporting strong usage of advanced marine coating solutions.

Competitive Landscape

The marine coatings market is moderately consolidated, dominated by established coating manufacturers with global distribution networks and strong R&D capabilities. Key players profiled in the report include:

Akzo Nobel N.V.

Chugoku Marine Paints, Ltd.

Hempel A/S

The Sherwin-Williams Company

RPM International Inc.

PPG Industries, Inc.

Nippon Paint Holdings Co., Ltd.

Kansai Paint Co., Ltd.

KCC Corporation

Axalta Coating Systems Ltd.

San Cera Coat Industries Pvt. Ltd.

Recent developments, such as PPG’s launch of NEXEON 810, a copper-free antifouling coating in March 2024, exemplify industry efforts to deliver sustainable, high-performance marine protection solutions. Similarly, Nippon Paint Marine’s NEOGUARD TOUGHNESS coatings were adopted by Wisdom Marine Group in January 2024 to reduce corrosion and minimize maintenance expenses across its fleet.

Market Segmentation

By Product

Anti-fouling

Anti-corrosion

Foul Release

Others

By Resin

Epoxy

Silicone

Alkyd

Others

By Marine

Dry Docking

New Shipbuilding

By Application

Coastal

Containers

Deep Sea

Leisure Boats

Offshore Vessels

Others

By Region

North America

Latin America

Europe

Asia Pacific

Middle East & Africa

Outlook

With rising investment in sustainable maritime operations and expanding shipbuilding activities worldwide, the Marine Coatings Market is poised for sustained growth across all major regions. The incorporation of eco-friendly materials, nanotechnology innovations, and biocide-free formulations are expected to reshape coating requirements across commercial and defense marine sectors.

The market’s long-term trajectory remains rooted in technological progress, regulatory alignment, and global maritime expansion—setting the stage for dynamic evolution through 2034.